Tariff Update

July 1, 2025

We write to update you on the status of new tariffs and their impact on workers who produce collegiate apparel. Key points are summarized below, with links for additional details.

Key Dates

- July 9: Very high reciprocal tariffs scheduled to return

- July 31: Federal appeals court arguments on tariff legality

- Fall 2025/Early 2026: Expected Supreme Court decision on tariff legality

Current Tariffs and Pending Hikes

There is a 10% tariff in effect on all US trading partners. This is added to the pre-2025 rate for each product (e.g., 16.5% for cotton t-shirts). The very high “reciprocal” tariffs imposed on most countries in April are suspended until July 9. The exceptions are Mexico and Canada, which are mostly tariff-free, and China, where the White House says a rate of 30% agreed in May is now final (added to two existing tariffs, this results in a grand total of 54% on a cotton t-shirt). Our Tariff Table (here) shows the pre-2025 rates, the current rates, and the rates that will take effect next week, unless the President postpones implementation or shifts course. Read more.

What’s Next?

Nobody knows, and the President probably hasn’t decided. He could postpone the reciprocal tariffs that are set to return July 9, delaying a final decision to allow more time for negotiations. He could do nothing and let those very high rates take effect. He could announce an entirely different set of rates. One plausible scenario is a mixture: with some countries enjoying a postponement of the reciprocal tariffs, pending further negotiations, and others being socked with high rates. Given the huge stakes, the degree of uncertainty that prevails in Washington is extraordinary. Read more.

Legal Challenges to Tariff Powers

The White House faces a major legal challenge, with a key trade court rejecting the basis for most of the new tariffs. The ruling is suspended, so the President remains unconstrained for now. The Court of Appeals will hear the case on July 31; it is likely the Supreme Court will ultimately decide it—this fall at the earliest but more likely in early 2026. If the administration loses, its powers won’t be eliminated: it can use alternate legal tools, but those options provide less freedom of maneuver. Read more.

Countries at Highest Risk

The 10% rate is already a big problem for apparel suppliers, but if the reciprocal rates return, some countries face drastic consequences. Countries that depend heavily on apparel for jobs and exports, sell a lot of their goods to the US market, and face very high rates include Cambodia, Bangladesh, and Sri Lanka. The tariffs could also scramble competition between countries and regions, resulting in geographic shifts in production and large-scale job loss in the countries that lose out. Read more.

Pressures on Suppliers, Impacts on Workers

Virtually all major US brands are requiring suppliers to bear at least some tariff costs, even though most factories were already operating on razor-thin margins. We are receiving reports of factories citing tariff pressure to justify:

- Mass furloughs;

- Stalled collective bargaining; and

- Denial of customary benefits and bonuses.

The risk of violations at collegiate factories is growing and will increase further if the reciprocal tariffs take effect. The WRC and our global team are currently investigating complaints from workers at multiple collegiate facilities. Read more.

The WRC’s message to apparel brands, including licensees, is to heed the labor rights consequences of pushing costs onto suppliers. University codes don’t prohibit licensees from seeking price cuts from factories, however ill-advised, but if they lead to violations of labor standards, the licensees are accountable. Also, if licensees relocate production, exiting responsibly from existing suppliers is necessary to avert severance theft.

Scott Nova and Sarah Reed

Worker Rights Consortium

Further Detail and Analysis

Rate of Tariffs on Garment Producing Countries

Although President Trump had long touted his plans for new tariffs, the breadth and scale of the so-called reciprocal rates unveiled April 2 far surpassed most observers’ expectations. Apparel producing countries were among the hardest hit, with a staggering 50%, 49%, 46%, and 37% imposed on Lesotho, Cambodia, Vietnam, and Bangladesh respectively. The proposed reciprocal rates imposed under the International Emergency Economic Powers Act (IEEPA) are in addition to pre-existing tariffs, as specified by the US Harmonized Tariff Schedule. It is worth noting that, prior to this year, apparel imports already faced among the highest rates for products entering the US.

On April 9, the administration delayed implementation of the reciprocal tariffs for 90 days for all countries except China, temporarily replacing the proposed reciprocal rates with an across-the-board tariff of 10% (on top of pre-existing rates). Mexico is the only garment producing country whose goods (if compliant with the United States-Mexico-Canada Agreement) can be sent to the US duty free. In the case of other trade agreements and laws that provided duty-free access for apparel to the US, the 10% duty does apply. This includes the Central America-Dominican Republic Free Trade Agreement (DR-CAFTA) and laws providing access to goods from Haiti.

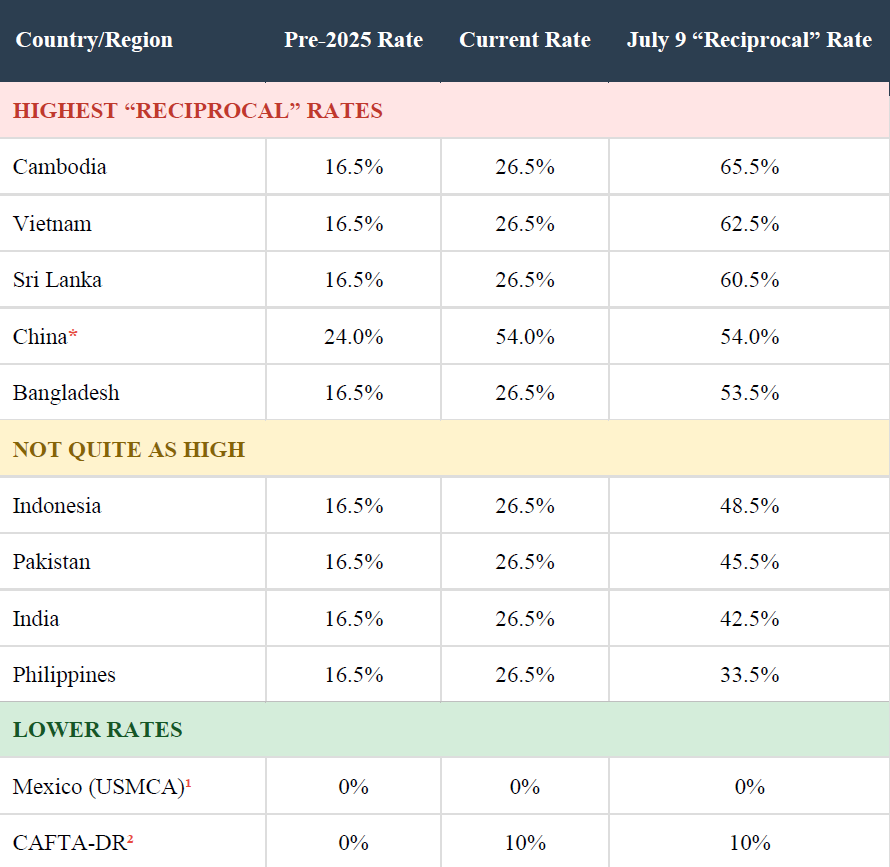

The Table below illustrates the tariff rates in place before 2025, the current rates, and the “reciprocal” tariff rates scheduled to hit on July 9. These rates are for cotton t-shirts, as an example. The table includes countries that are significant producers of collegiate apparel. back to top

Table: US Tariff Rates, Collegiate Apparel Suppliers

Table shows rate for cotton t-shirts, as an illustration.

Notes:

* China: The 54% rate includes: standard apparel tariff (16.5%) + Section 301 tariff (7.5%) + fentanyl tariff (20%) + reciprocal tariff (10%). This rate is expected to remain stable following the June 2025 US-China “framework” agreement.

¹ Mexico: Rate applies only to USMCA-compliant goods.

² CAFTA-DR: Includes Costa Rica, Dominican Republic, El Salvador, Guatemala, Honduras, and Nicaragua. Rate applies only to agreement-compliant goods. back to top

China Tariffs

After April 2, a tit-for-tat escalation with the Chinese government resulted in the administration imposing a tariff of 125%—in addition to the 20% already imposed earlier in the year, related to alleged fentanyl trafficking. These were added to the pre-existing tariffs: including 7.5% on all apparel, imposed under the first Trump administration under Section 301 of the Tariff Act, and the pre-2025 rate for any given product. For a cotton t-shirt, this brought the total to 169%. The administration also rescinded duty-free “de minimis trade access” for Chinese products and exposed parcels worth $800 or less to a 120% tariff.

On May 12, following negotiations with the Chinese government, the President implemented tariff reductions that brought the overall rate for a Chinese made t-shirt from 169% down to 54% (he also dropped the universal rate for de minimis eligible packages to 54%). Subsequently, Secretary of the Treasury Scott Bessent announced a “framework agreement” between the US and China, for which the counterparts reiterated their support last Friday. Communications from the administration indicate that the rates agreed on May 12 are final, though a shift from this position is still conceivable. back to top

Legal Challenges to New Tariffs and the Administration’s Options if It Loses in Court

On May 28, the US Court of International Trade (CIT) issued a permanent injunction on the administration’s use of the IEEPA, the statute that serves as the legal basis for most of the Trump administration’s tariffs. By law, it is Congress that sets tariffs; that is why the Trump administration used IEEPA to justify the President setting tariffs without Congressional action. The CIT says the administration acted unlawfully in doing so.

The US Court of Appeals for the Federal Circuit then stayed the ruling the following day. In a separate lawsuit with the District Court for the District of Columbia (DDC), a federal judge issued on May 29 a preliminary injunction on the tariffs, although this decision applied only to the specific plaintiffs, who are small businesses. This ruling was also stayed, and the Supreme Court has declined requests by the plaintiffs to hear the case prior to the lower court’s ruling.

While both challenges will be heard by appeals courts on an expedited basis, the courts are allowing the tariffs to move forward while the appeals are pending. The US Court of Appeals for the Federal Circuit will hear the case on July 31, meaning that the administration is free to reimpose the reciprocal tariffs as planned on July 9. The legal questions surrounding the President’s use of IEEPA will likely be settled by the Supreme Court. Because the Supreme Court does not reconvene until October, we will not know the final outcome of these challenges until late autumn at the earliest and possibly not until 2026.

Should the Supreme Court uphold the lower court rulings and strike down the administration’s use of IEEPA, that is not the end of the road. The President could impose new tariffs through other legal means. However, the powers granted by those alternate routes are generally more restrictive (either capping rates, limiting scope to specific industries, or setting time limits for how long tariffs will remain in place) and in some cases more cumbersome to use (requiring formal investigations of trading partners before action can be taken).

Section 122 of the Tariff Act of 1930 would allow the administration to impose tariffs across the board, but it caps the rates at 15% and sunsets them after 150 days. Section 301 of the Tariff Act allows the president to impose tariffs in response to another country’s unfair trade practices (applied already on a wide range of Chinese imports under the first Trump administration), but only after an investigation of those practices. Section 232 of the Trade Expansion Act authorizes tariffs only on specific sectors for national security reasons (as the administration has used recently against steel, aluminum, and auto imports), and also requires an investigation before action is taken.

The President could also conceivably invoke Section 338 of the Tariff Act, which authorizes the imposition of tariffs of up to 50% on goods from countries that “discriminate against commerce of the United States”. The provision is very broad on paper but has never been used in the Tariff Act’s 95-year history and its legal viability is uncertain.

It is hard to envision a scenario in which the Trump administration will stop imposing tariffs. And the soonest its powers could face any significant limitations is this autumn. It is possible, however, that many of the tariffs the administration has put in place will be invalidated in late 2025 or early 2026, forcing the administration to try to re-impose them without the virtually unlimited power it currently claims. back to top

What’s Next?

There is tremendous uncertainty around the administration’s intentions relative to the current tariffs and to the July 9 deadline for the return of the sky-high reciprocal rates. As of this writing, the most likely scenario is another postponement of the reciprocal tariffs. But a postponement could well be partial: with the White House sparing some countries the reciprocal rates, pending further negotiation, and imposing the reciprocal rates on others.

The administration initially indicated it was willing to undertake bilateral trade negotiations with many impacted countries. The President seemed to reverse this position in May, stating that the US would simply “inform” countries of their tariff rates in the coming weeks. Secretary of the Treasury Scott Bessent then later stated that the administration was prioritizing 18 important trading partners for negotiations, though the only one he named is the European Union (EU).

It is likely that there will be negotiated deals with at least some countries that are a higher priority for the administration (e.g., EU countries, Vietnam, India), though these may not be concluded until later in the year. It is possible that “framework” agreements will be announced next week with such countries, with the details to be worked out later.

What will happen to countries viewed by the US as less important trading partners, like Cambodia and Bangladesh, remains anybody’s guess. Those countries could well be assigned a final rate without the opportunity for dialogue.

Bessent told Congress two weeks ago that the President could delay the deadline to give more time for negotiations, and he reiterated that point on Friday, June 27. As for the President, he told reporters the same day that “We can do whatever we want” with respect to the deadline—then on Sunday said he “didn’t expect” to extend it. Mixed messages from the administration only add to the uncertainty. By late next week, we will have at least somewhat more clarity.

Notably, US Trade Representative Jamieson Greer has stated that, whatever else happens, the administration intends to keep in place permanently the current 10% universal tariff. back to top

Potential Impact on Garment Producing Countries

For garment producing countries, especially those that rely heavily on apparel exports to the US, the reciprocal tariffs are potentially catastrophic. The apparel and textile workforce represents 73% of formal sector employment in Cambodia, 35% in Bangladesh, and 27% in Sri Lanka. Of countries that produce university logo apparel, these three are the most vulnerable to economic and labor shocks if the reciprocal tariffs are implemented.

The tariffs could also scramble geographic competition between garment producing countries, actually helping some producers. If the original tariff rates proposed on April 2 move forward in July, or at some later date, it is plausible that Mexican and Central American factories will see a surge in business, while the role of apparel giants like Bangladesh, Vietnam, and Indonesia will diminish. Some Indian manufacturers are optimistic that the country’s comparatively lower reciprocal tariff rate would present a competitive advantage compared to its neighbors Bangladesh and Sri Lanka. The Philippines could also benefit. Obviously, one country’s gain is another’s loss, and major shifts would create a risk of widespread severance theft. back to top

Pressure on Suppliers, Impact on Workers, and Implications for Licensees

The WRC has previously raised concerns about the implications for workers of buyers pressing suppliers to bear part of the costs of new tariffs. Given that many suppliers operate on margins of 3-5%, being asked to absorb even half the cost of the current 10% tariff hike will drive prices for most producers below the cost of production.

We have now received reports from suppliers around the world that produce for US apparel brands, complaining of pressure from customers to cut prices in the face of the new tariffs. Based on these reports and conversations with other industry sources, the WRC believes that virtually all major brands are requiring suppliers to bear at least some of the new costs. Notably, Business & Human Rights Resource Centre (BHRRC), which surveys multinational brands on labor rights matters, sent a questionnaire asking major apparel brands if they are committed to avoiding tariff-related price demands that might drive labor abuses. BHRRC usually gets a good response rate on its surveys. In this case, not a single company responded.

We have begun to receive reports from workers about the impacts of these price demands. Workers have identified delayed wages, the nonpayment of annual bonuses, and collective bargaining impasses among the actions taken by factory managers, using price pressure related to the tariffs as justification. Workers at one factory reported that management converted part of their bonuses into a loan, which workers will have to pay back through payroll deductions.

Unsurprisingly, there are also numerous reports of layoffs resulting from buyers reducing or postponing orders. Of particular concern are allegations of employers, faced with the need to reduce operations, taking advantage of the circumstances to target worker-leaders.

The WRC is investigating multiple complaints from workers at collegiate factories of labor rights violations that may be related to tariff pressures. We will carry out these investigations and related remediation efforts consistent with our regular investigative protocols and report to affiliate universities accordingly. We anticipate reporting on one important case within the next few weeks. back to top

Resources and Further Reading:

- Kate Nishimura, “Apparel Tariffs Climbed to Historic Highs in April,” Sourcing Journal, June 13, 2025.

- Planet Money, “Are Trump’s Tariffs Legal?” NPR, June 11, 2025.

- The Tax Foundation, “Trump Tariffs: Tracking the Economic Impact of the Trump Trade War.”

- Rethink Trade on YouTube.

- Reed Smith, “Trade Compliance Resource Hub.”

- US Harmonized Tariff Schedule.